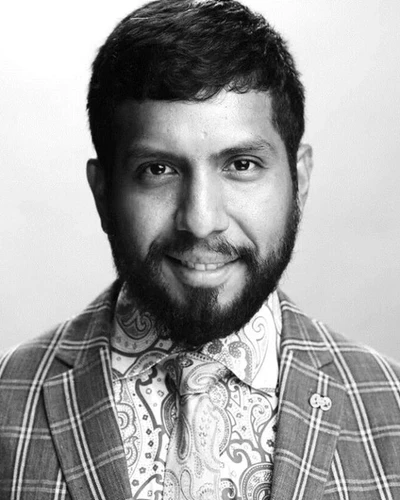

Fabian Vera

Corporate Reserves Consultant

Mire Petroleum Consultant

Mr. Vera is a corporate reserves consultant at Mire Petroleum Consultants. He earned a Master of Science in petroleum engineering at Texas A&M and an MBA from MIT Sloan x Asia School of Business. His focus on reservoir engineering and reserves development produced research and awards including the 4th place Young Professional Paper award at IPTC Qatar (2014), Judge for OTC’ Spotlight in Technology (2017-2018), 3rd Place Award at OpenEarth Community Hackathon (2018), Winning the bid for Cardano Foundation Summit in Kuala Lumpur (2022), and MIT’ Social Media Maven award (2023). His recent endeavors includes a patent-pending hybrid engine in energy commodities.

Participates in

TECHNICAL PROGRAMME | Energy Leadership

For this study, feedback loop models through Minsky, an open-source modeling tool primarily used in economics, were done to determine both stocks (oil reserves) and flows (futures trading) and model complex interactions of oil and gas trading over time. The inclusion of market modeling, using godley tables that enable financial flow, complements this work by employing econometric models, options pricing, and time series analysis to forecast prices and market trends, particularly for commodity trading. This hybrid approach linked physical trading dynamics to speculative financial behavior.

A tale of two markets became apparent in the last 15 years as the ratio of paper barrels to physical barrels traded on the futures market went from roughly one to one to 60:1 today highlights the growing influence of speculation, making the case for virtual barrels. As the world currently consumes more than 100 million b/d of oil, the volume of trades in petroleum futures, options, and over-the-counter derivatives comes up to 6 billion b/d. For LNG markets in 2025, the presence of regional competition between northeast Europe (TTF) and northeast Asia (JKM) showed a ~US$2/BTU premium due to spot-market rerouting. The aggregation of these estimates to machine learning models like XGboost and N-HiTS that captures non-linear patterns led to creating more robust price forecasting in U.S. and China demand, achieving lower weighted Mean Absolute Percentage Error (MAPE) of 3.5% and 10.3% respectively.

Combining system dynamics with existing machine learning uniquely bridges causal feedback and nonlinear patterns, offering a holistic view that connects physical operations and financial strategies in the oil and gas industry. This integration offers a more accurate price forecast, more resilient strategies, and better decision-making that are critical for navigating volatility in interconnected markets.